Private equity professionals, operating in a complex and high-stakes environment, need to learn from their experiences and continuously enhance their skills.

A recent study by Aamir A. Rehman of Columbia University explored the “Learning Cycle” through which private equity professionals convert experience on deals into enhanced skills and capabilities.

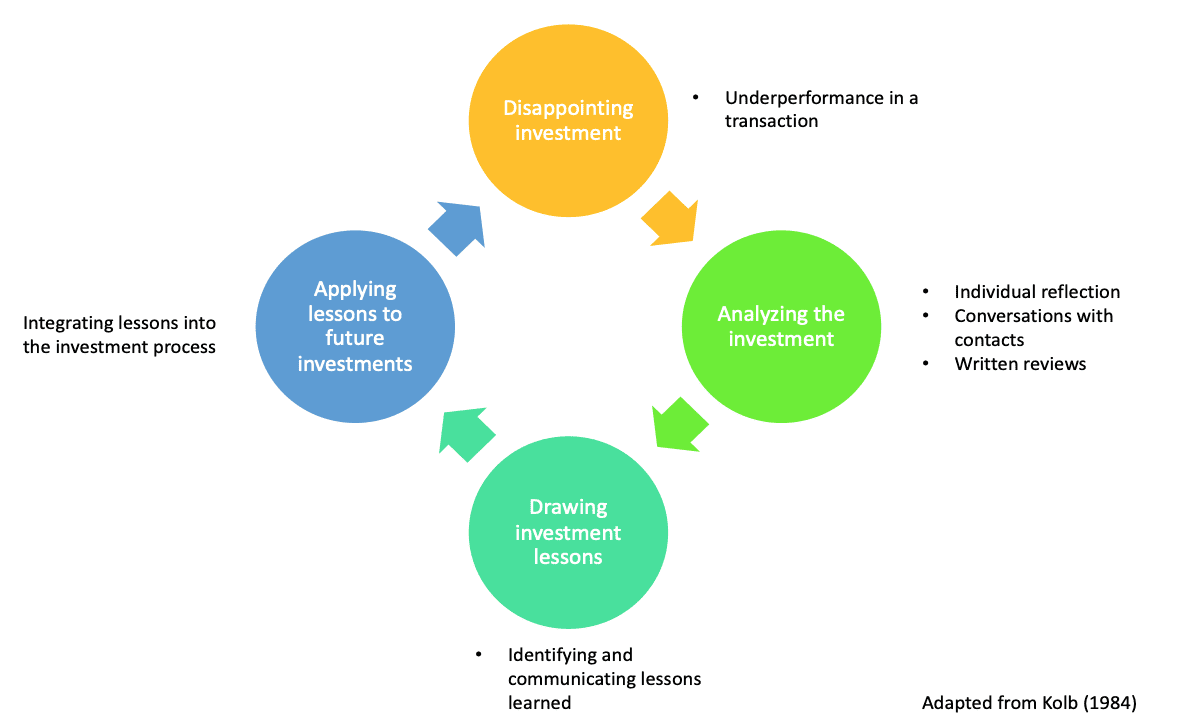

The Learning Cycle

The concept of a Learning Cycle (developed by Kolb in 1984) was adapted by Rehman to describe how private equity professionals learn from experience.

The first step in the cycle is a concrete experience with a disappointing investment. The next step is analyzing that investment through individual reflection, conversation with contacts, and written reviews. The third step is drawing investment lessons based on the outcomes of the previous deal. The fourth and final step is applying those lessons in future investments.

In interviews with successful private equity professionals, Rehman consistently found individuals and firms engaging in a Private Equity Learning Cycle.

How to Improve Learning

Rehman found that some private equity professionals and firms had much more robust processes than others. Although investors generally used some form of a Learning Cycle, many were informal and unstructured in their approach.

Rehman recommends that firms be more deliberate in their use of the Private Equity Learning Cycle. This includes adopting formal processes for document business outcomes and formal processes for capturing learnings. Investment teams should be required to document their learnings from each deal, and how they will apply them to the next.

Rehman also recommends that private equity investors learn from their successes as well as their failures. He found that professionals tend to focus on learning from mistakes — especially as their body of experience grows. Learning from successes, however, can be just as important. Doing so better allows firms to uncover the causes of their success and then repeat them in future transactions.