Check this out – a surprising 64% of US day traders end up losing money, leaving only a modest 36% who actually make profits. Active day traders in the United States exhibit an annual underperformance of 10.3% when compared to a simple value-weighted index. Surely, the odds are tough!

These numbers are not shared to scare off newcomers, but it’s crucial to approach stock trading with caution and a solid strategy. You’ve gotta be prepared for the challenges ahead.

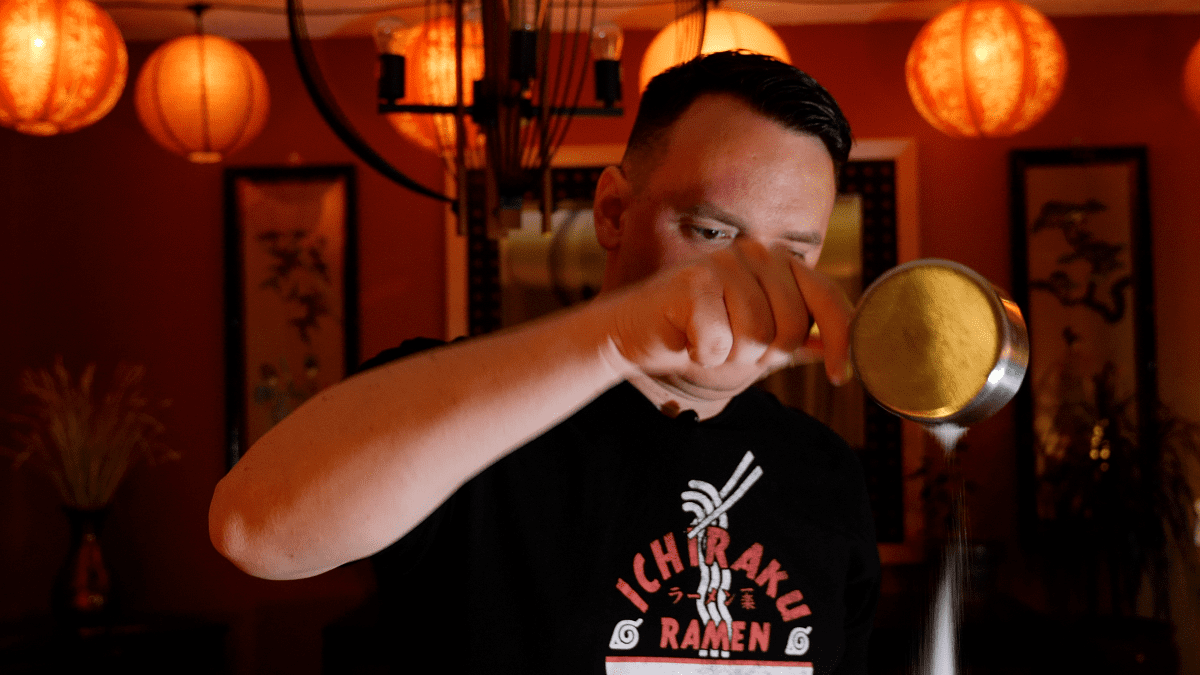

But hey, here’s some inspiration – David Capablanca, an experienced and savvy trader, found a different path to success. He explored pre-market short selling and made some seriously remarkable profits.

So, it goes to show that with the right approach, there are still opportunities out there. You just have to stay smart and informed.

David’s background is a true melting pot of cultures, with his mother hailing from Cuba and his father from Iran. He originates from the vibrant city of Miami, FL. He pursued a Master’s degree in architecture, but life took a turn, and he entered the world of trading.

With a verified 90% win rate in short selling, David’s expertise in the stock market has caught the attention of industry giants.

He has a podcast on YouTube where he talks to expert traders and discusses the latest strategies of trading. To add to his list of accomplishments, David turned an initial investment of 29k into an astounding 800k+ in the stock market.

Now, this is the kind of success that demands admiration and respect.

Pre-market short-selling is one of his major fields to play in. One essential concept he emphasizes is understanding “asymmetric risk,” where the potential for profit outweighs the risk involved. This is, without a doubt, a crucial lesson for any trader striving to make it big in the market.

He has mastered the skill of identifying potential plays in the pre-market.

He sheds light on the significance of factors like Nasdaq rules, lock-up expirations, and warrants in shaping his strategy on his podcast. Understanding these elements can be the key to unlocking lucrative opportunities in the pre-market landscape.

David reveals two important aspects of his trading strategy. First, he skillfully leverages Think or Swim and Trade Ideas scanners. He uses these scanners to identify over-extended stocks up on fluff news or for no reason at all.

The important point to be noted here is that quick and adaptive execution is crucial, as David capitalizes on these momentary market inefficiencies and profits from them.

Among the various pre-market trading strategies that David talks about, two of them stand out; one is the “Two-Step” strategy. This involves identifying stocks that consolidate and then making a second move, creating a stair-step pattern. The second is one he classifies as a pre-market “Straight Spike” pattern. In this, traders focus on stocks that spike and then sharply drop, presenting enticing opportunities for quick gains.

Getting skillful enough in all these strategies requires a long time of learning from notes, mentors, and fellow traders. Then begins the rocky road of hit and trial and gaining experience as you go.

Still, even after establishing yourself in the trading world, it’s not all sunshine and rainbows. Not even for someone as skilled as David. You will face both good times and challenges.

The insights taken from David’s wisdom emphasize that success in this field demands substantial hard work and dedication to daily learning and improvement.

You have to learn how the market works and, of course, the art of risk management. It is true that stock trading offers potential rewards. However, it is essential for novice traders like yourself to learn and adopt cautious practices before jumping on the playing field. And the easiest yet toughest of all, staying disciplined is a must.

And who better to learn all this form than the ace trader David? Start your journey in trading today with him!

To learn more about David and pre-market short selling, listen to his podcast and join his academy. You can also follow him on Twitter and LinkedIn to keep yourself updated with the world of trading.